Meet Flexloan™: Your loan, your choice, you’re in charge

You own the process - Loan pre-qualification without vehicle selection

Easy, self-serve - be empowered to choose

Know before you go - get pre-qualified first

Use Flexloan at any dealership

One Flexloan pre-qualification protects your credit

Multiple dealership applications can hurt your score

Multiple dealership applications can hurt your score

Leave Traditional Auto Loans In The Past

Fast & Frictionless

Apply online in minutes and check if you pre-qualify, without impacting your credit score. No in-person paperwork required.

Transparency & Clarity

Get greater clarity, control and confidence with Flexloan’s straightforward, fixed-rate financing. Pre-qualify and know your buying power upfront.

The Power to Choose

Finance up to $45,000 for a single vehicle, and use it to buy any eligible new or used model from the dealership of your choice.

Data-Driven Insights

Make smarter buy and sell decisions with V³ Valuation™, which lets you track and predict any vehicle’s worth over time.

Flexloan: Straightforward single-vehicle financing.

A one-time auto financing option available through Carputty’s lending partner, Westlake Direct, for qualified individuals looking to fund a single vehicle purchase with straightforward terms.

Minimum Credit Score:

600*

600*

Loan Amount Range:

$8,500 - $45,000

$8,500 - $45,000

Use It To:

Buy new or used from a dealership

Buy new or used from a dealership

Vehicle Eligibility:

Up to 10 years old, and up to 150K miles

Up to 10 years old, and up to 150K miles

Terms:

24-72 months

24-72 months

*Pre-qualification is determined by credit score and other factors

Apply NowHow it Works

Start with a quick application to explore your financing options—without impacting your credit.

How it Works

Get on the road faster with one application.

Start with a quick application to explore your financing options—without impacting your credit.

>

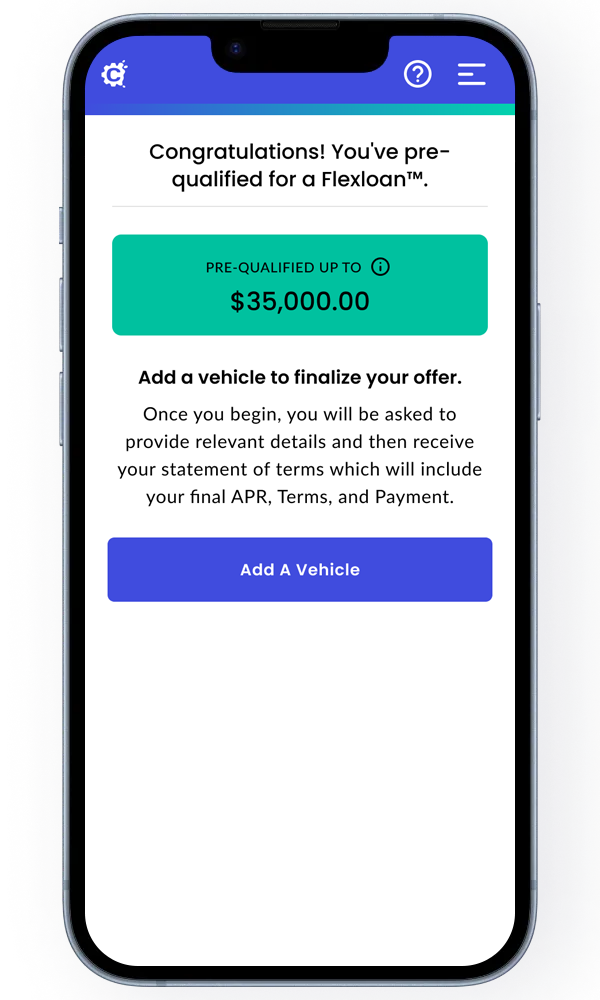

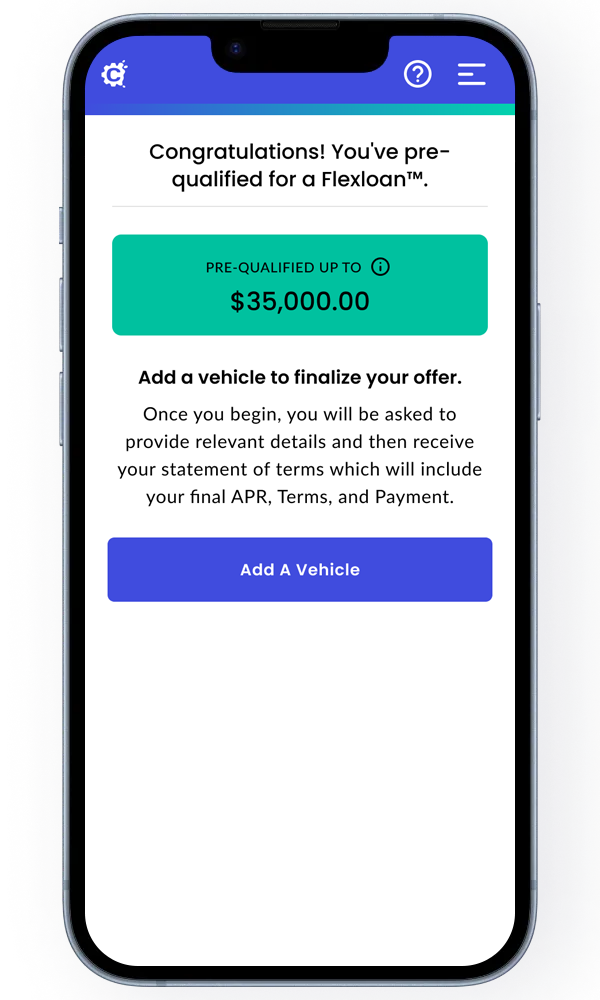

Check Pre-Qualification

Submit a few details for a soft credit check. You’ll instantly see your pre-qualified amount.

>

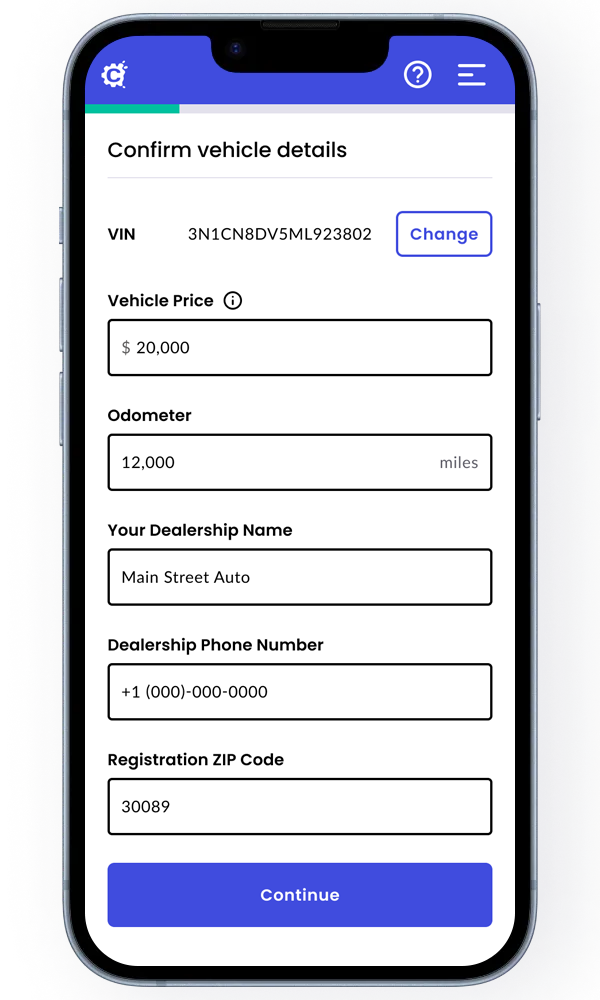

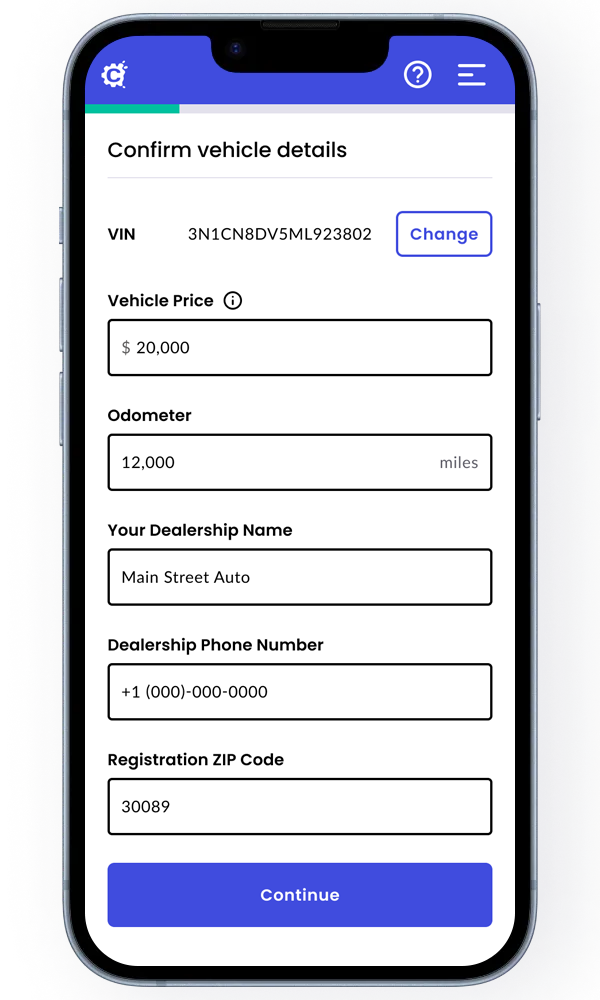

Add a Vehicle

Submit VIN, mileage, and dealership details.

>

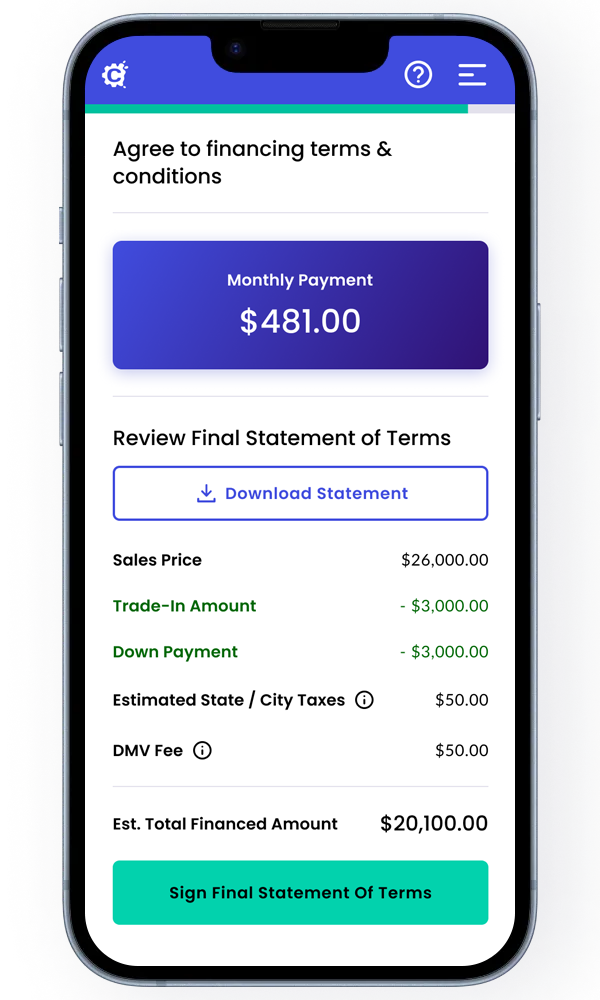

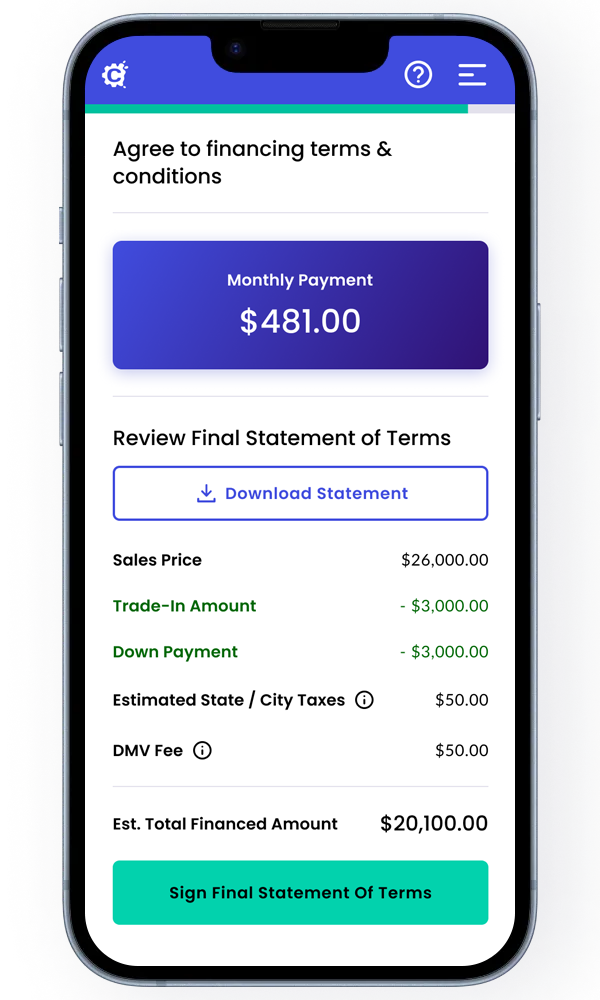

Final Approval

Once your info is submitted, we’ll run a hard credit check and finalize your loan terms.

>

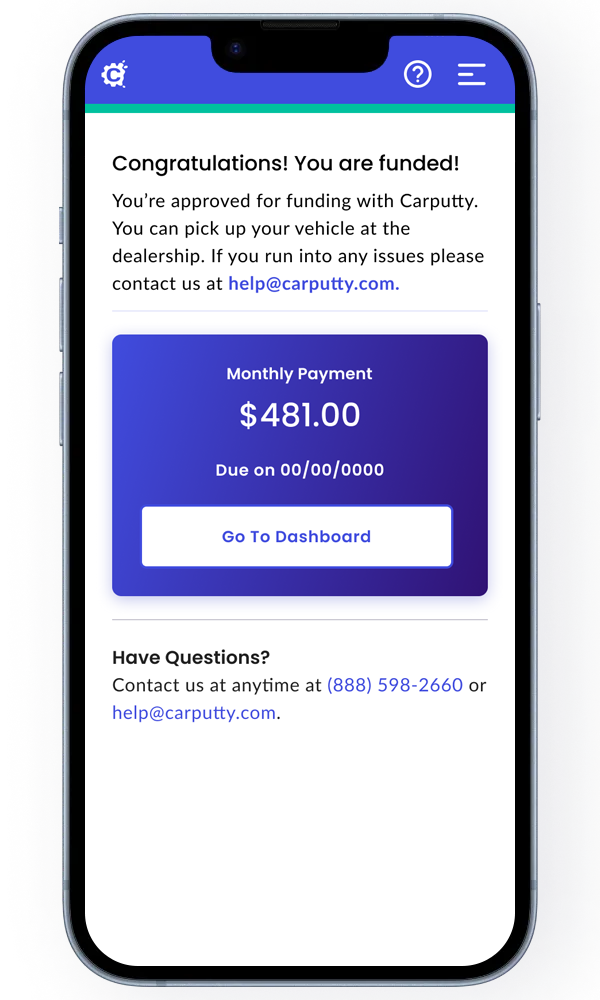

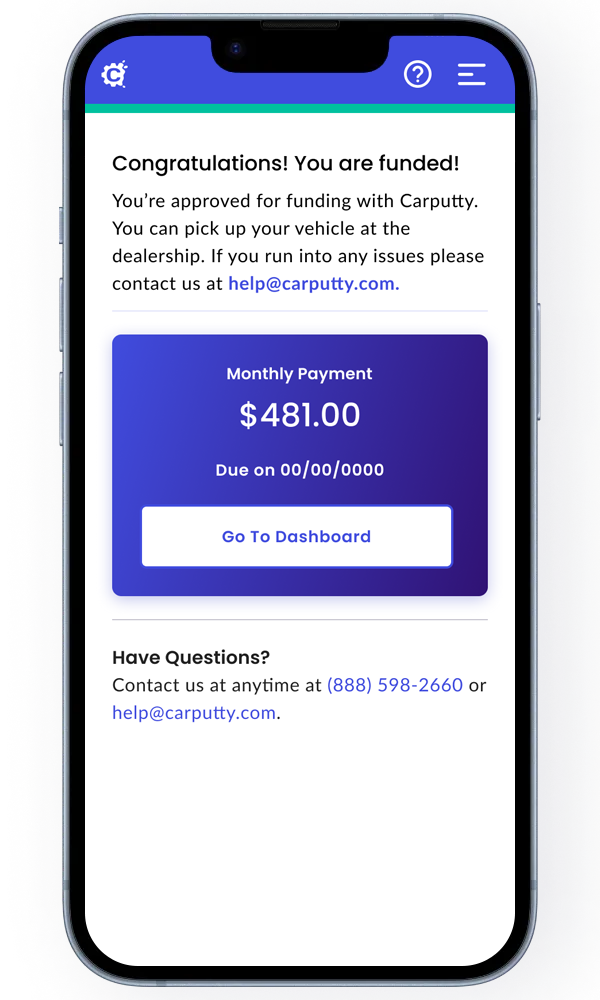

Fund & Drive

Once approved, funds will go directly to the seller, and you're ready to drive.

Hear what other members have to say

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Behind the wheel

Hear what our members have to say.

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Steven S.

Great insight into when to sell

“The site also has [given] us great insight into when the best time to sell the Tiguan.”

Noel M.

Unbelievable service, seriously.

“I will always buy my vehicles through Carputty.”

Alexander L.

Lines of credit for auto financing

“I now have a line of credit I can use towards future car purchases...”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Leon A.

A great fintech company

“Their process is smooth and seamless from beginning to end.”

Corey H.

Carputty has changed the game.

“Carputty makes the finance portion [of automotive transactions] seamless...”

Terry B.

Easy, seamless and fast

“Carputty made buying a breeze. Great experience great customer service!”

Ready for a better way to finance your vehicles?

Flexloan offers a clear, flexible alternative to traditional auto loans—powered by data and built for drivers like you.

Get StartedFAQs

How is Carputty different from other lenders?

Carputty was built to modernize auto financing. We’ve replaced outdated, one-size-fits-all loans with a smarter, more flexible approach that puts the power back in the hands of the buyer. Our platform is designed for transparency, security, and control—helping you finance vehicles on your terms, track their value in real time, and make decisions with confidence. Whether you're buying one car or managing a fleet, Carputty offers tools that evolve with you.

What are Carputty’s Flexloan™ eligibility requirements?

To qualify for a Flexloan, you must be at least 18 years old, reside in a supported U.S. state (excluding DC, MS, and NV), and have a minimum credit score of 600. Eligible vehicles must be 10 years old or newer, have fewer than 150,000 miles, and hold a clean, marketable title. Flexloans are single-vehicle loans serviced by Westlake Financial and can be used for new or used purchases, refinancing, or lease buyouts. You can view your Flexloan in the Carputty dashboard, but all payments and account management must be handled through Westlake.

What types of transactions can I fund with a Flexloan™?

A Flexloan can be used to fund several types of vehicle transactions, including:

- New vehicle purchases

- Used vehicle purchases

Can I get a Flexloan™ if I already have existing car loans?

If you have an existing car loan, you may still be eligible for a Flexloan. However, Westlake Direct limits borrowers to a maximum of two active auto loans at any given time. If you already have two or more open auto loans, you would not be eligible for a Flexloan.